Strategies For Buying Equity Indexed Universal Life Insurance

With equity indexed universal life insurance, a clear strategy, or policy objective, should always be identified before making any purchase. Premiums for all universal policies are flexible, so the policyholder’s objective has a significant impact on how the policy is funded. There are a number of different strategies for buying an indexed universal life policy including paying the minimum premium, paying the no-lapse premium to guarantee the policy for the insured’s lifetime, or paying the maximum premium also known as overfunding. The strategy that you select will be determined by your personal goals and objectives, but the strategy most effective for equity-indexed universal life insurance is the retirement income strategy or overfunding strategy.

| Retirement Income Strategy- “Overfunding” an Equity Indexed Life Policy | |

| The Internal Revenue Code and Life Insurance Strategies* | |

| How to Overfund Indexed Universal Life for maximum retirement income |

Retirement

Income Strategy- “Overfunding” an Equity

Indexed Life Policy

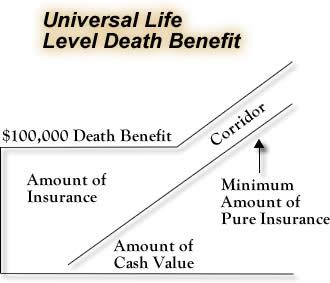

To “overfund” an indexed universal life insurance policy means to maximize the policy’s cash value growth potential and minimize its net insurance costs over time. When the maximum premium is paid into the policy, cash values grow faster which leverages the net amount of life insurance at risk. The net amount of life insurance at risk is the difference between the actual face amount of the policy less the current cash value, see diagram below. With all universal life policies, insurance costs are calculated based on the amount of life insurance at risk at any given point in time. As the net amount of insurance at risk decreases, the costs of insurance decrease and a higher portion of the premium payment can be directed to the indexed account. By overfunding the policy, cash values can leverage the cost of insurance therefore maximizing the cash value growth potential. For more information on insurance costs and the net amount of insurance at risk see, “How a universal life insurance policy works”.

The Internal Revenue Code and Overfunding

Life Insurance*

To better grasp the powerful concept of “overfunding” a life insurance policy, one must clearly understand the IRS regulations that must be met to avoid unnecessary taxation. Some of the legislation affecting the strategy of overfunding indexed universal life includes Internal Revenue Code Section 7702A, the Deficit Reduction Act of 1984 (DEFRA), and the Technical and Miscellaneous Revenue Act of 1988 (TAMRA).

Internal Revenue Code Section 7702A describes the seven-pay test which requires that cumulative life insurance premiums over any seven year period cannot exceed the seven-pay premium limitation. The seven-pay premium limitation is the maximum cumulative gross premium payment over any seven year policy period. Seven-pay premiums are calculated based on the specific insurance company’s cost structure and the insured’s age, health class, sex and benefit amounts. If the policy is overfunded up to or within the seven-pay premium requirements, then it will meet the Internal Revenue Code and policy cash surrender values may be accessed at any time tax-free. If premiums exceed the seven-pay test maximum, the life insurance policy becomes a modified endowment contract (MEC) and may incur taxes on distributions of cash values.

The Technical and Miscellaneous

Revenue Act of 1988 (TAMRA)

The Technical and Miscellaneous Revenue Act of 1988 (TAMRA) first defined a modified endowment contract (MEC) as a life insurance policy that fails to meet the premium limitations established under the seven-pay test. Once a policy is classified as a MEC, any policy cash value distribution above the policy’s premium basis will trigger a taxable event which includes a 10% penalty tax on any gain received prior to the policy holder’s age 59 1/2. The policy’s premium basis is usually the sum of all premium payments less any dividends received. Policy distributions are any surrenders, withdrawals or policy loans. The intention of overfunding any universal life policy is to access cash values at some point in the future, so a MEC should be avoided at all costs with this strategy.

The Deficit Reduction Act of 1984 (DEFRA)

The Deficit Reduction Act of 1984, DEFRA, sets the minimum policy death benefit based on the sum of the premiums paid and the age and gender of the insured. Sometimes referred to as “the cash value corridor test” or “guideline premium test”, this requirement in effect limits the amount of premium payments for a given minimum face amount of insurance. Complying with DEFRA limitations is required for a policy to maintain its status as life insurance. If overfunding an indexed universal life policy is a strategy you are considering, DEFRA will in effect establish the minimum death benefit based on any maximum premium payment.

How to Overfund Equity Indexed Universal Life Insurance

Overfunding is a life insurance cash accumulation strategy that leverages the maximum allowable policy premiums with the smallest life insurance death benefit to achieve highest return on premium payments net of policy costs over a given time period. There are essentially 3 steps to determining the combination of maximum premiums and minimum death benefits necessary to selecting the most leveraged indexed universal life policy:

| 1. | The first step is to determine your maximum premium commitment over your given time horizon. The premium amount selected should be an amount that you can consistently and easily make without interruption. Universal life insurance polices offer the capability for flexible premium payments, but to get the maximum leverage you must stick to your premium commitment for a given face amount of insurance. |

| 2. | Secondly, you must determine the minimum insurance face amount for the DEFRA commitment and age and gender. The insurance company’s sales illustration will provide the actual premium amount limits that meet the DEFRA minimum requirements. |

| 3. | Finally, determine the maximum premiums allowable under Internal Revenue Code 7702A and the TAMRA seven-pay premium limitation. As discussed above, as long as the total premiums or any seven year period are equal or less than the maximum allowable premium for the seven-pay test, cash surrender values may be accessed ay any time tax-free. |

Once each of the IRS regulations above are met, the maximum premium allowable for the minimum death benefit is defined and the equity indexed universal life policy can be constructed with the optimum policy premium for the overfunding strategy. By choosing the overfunding approach, a policy holder can take complete advantage of all tax advantages of the life insurance policy and with reasonable index interest credits accumulate a significant cash value that may be access in retirement tax-free.

A final point on overfunding a universal life insurance policy is that it is a long term strategy! Because of the insurance costs and expenses associated with buying an equity indexed universal life policy and the likely fluctuations in indexed interest credits, the time horizon for growing and accessing cash values should be at least ten years or longer. It will take some time for the leveraging effect to reduce the costs of insurance and thereby increase the net rate of return on policy premiums. Keep in mind, policy costs are a necessary evil to maximize tax advantages and the bottom line is return over time on your premium payments.

* The above tax information is for information purposes only and is provided to explain the basic tax treatment of life insurance based on the Internal Revenue Code. Any individual or entity considering any life insurance policy should consult with their own independent advisor that understands their particular tax circumstances. This information is not intended to be tax or legal advice.