What is Equity Indexed Universal Life Insurance?

Equity Indexed Universal Life Insurance

Like traditional universal life insurance, equity indexed universal life (EIUL) offers numerous advantage including flexible premium payments, low cost permanent life insurance, tax deferred growth of cash values with borrowing ability(1), tax free death benefits (2) and the ability to adjust a policy to meet specific personal or business needs.

The major difference with equity indexed universal life is the option to participate indirectly in the upward movement of a stock index without accepting the normal risk associated with investing in the stock market. The actual interest credited to a policy’s cash value is determined by the annual changes of an equities index (excluding dividends). Most insurance companies use the S & P 500 Index® (3) as the underlying index for their equity indexed life product. For more information on equity indices, see “What is an equity index?”

With equity indexed life, in years where the underlying equity index increases, the policy cash value is increased up to a certain limit usually referred to as the growth cap. The cap varies among insurance companies but is currently somewhere around 10-14% annually. In years where the underlying equity index is flat or loses value, the cash value is subject to the growth floor. The floor is generally guaranteed to be 0%. Additionally, some companies offer a cumulative guarantee that assures a minimum effective interest rate over a given time period. This combination of the potential to realize higher upside returns without the downside risk makes the equity indexed life insurance policy a unique and attractive cash accumulation vehicle. For more information, see “How the Equity Indexed Universal Life Insurance Policy Works”.

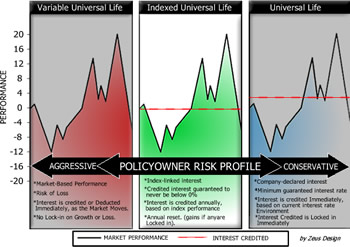

As the chart below shows, the real value of the equity

indexed universal life policy is its ability to earn

a credited interest rate higher than a traditional

universal life or whole life insurance policy without

accepting the risk of loss associated with

the variable

universal life policy. The equity indexed universal

life policy is designed to capture the best elements

of both the fixed whole life and the variable life

policies enabling it to earn an acceptable “middle

of the road interest rate” without taking on

unnecessary risk.

Please

Click on the picture for a larger view

(1)

Growth on accumulated cash values is generally taxable

only upon withdrawal. Adverse

tax consequences may result if withdrawals exceed premiums

paid into the policy. Policy loans from life insurance

policies generally are not subject to income tax. A

policy withdrawal or loan will reduce the insurance

policy’s ultimate death benefit and cash value.

Additionally, depending on the insurance company, a

surrender charge may apply if the policy cash values

are fully surrendered before the surrender period expires.

Please consult with your attorney or tax advisor

(2) Proceeds from a life insurance policy paid upon

the death of the insured are in most cases excluded

from the beneficiary’s gross income.

(3) The S & P 500 (Standard and Poor’s Composite

Price Index) is composed of 500 commons stocks representing

major U.S. industry sectors.

“

Standard and Poor’s®,” “S & P®,” “S & P

500®,” “Standard & Poor’s

500,” and “500” are trademarks of

The McGraw-Hill Companies, Inc. Equity indexed universal

life insurance is not sponsored, endorsed, sold or

promoted by Standard & Poor’s and Standard & Poor’s

makes no representation regarding the advisability

of purchasing such a policy.